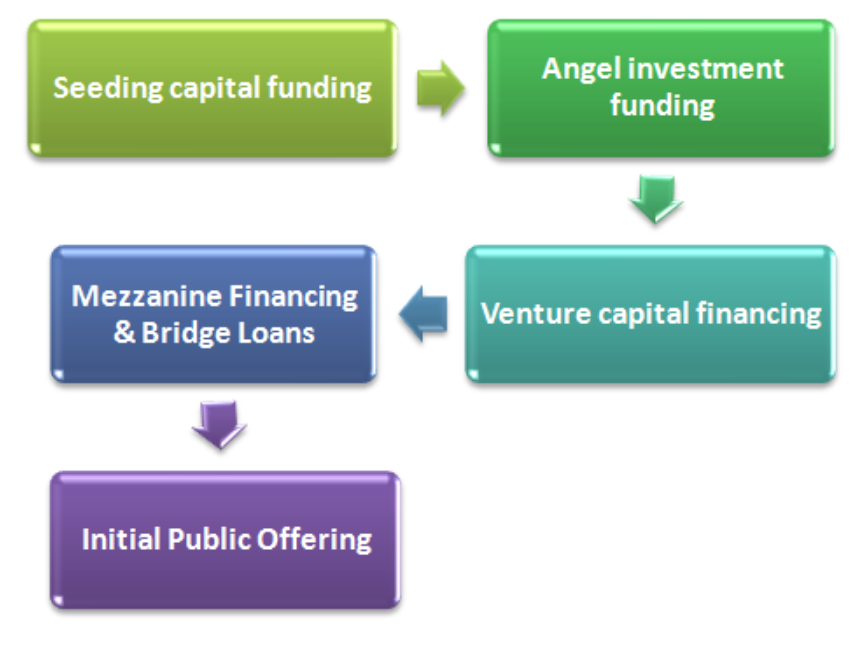

What are the stages of startup funding?

A brilliant idea needs perfection, discipline, dedication, and above all, enough capital to materialize. Small Business Credit Survey (SBCS) indicates that the Medium- and high-credit-risk applicants seeking funding from online lenders rather than banks were 54% and 50%, respectively. A clear indication that these businesses are still finding finical deficits despite the high credits. They, therefore, need to go through the startup funding process to attain stability.

Despite the fact these businesses serve as the main source of income for most entrepreneurs, they are not yet fully established and need a financial boost to reach the maximum heights. For that, we need to go through the necessary stages of startup funding to help you prepare for the last strides that will transform your business forever.

Seeding capital funding

The most initial of all the funding options is seed capital funding. It entails the most basic sources of funds anyone would access within their small confinements. Some of these include banks, friends and families, crowdfunding, personal savings, and credit cards.

The funding at this initial stage aims at getting the business on the right track. A lot of research, product or service redefinition, and idea realignment takes place.

However, it doesn’t matter whether the money given this stage is a gift or refundable. Somehow somewhat, it is a debt to the business and must be accounted for fully and owed to the lenders.

Also, remember, the few sources of funds at this stage are based on mutual trust and nothing tangible. Little proof of operation is mandatory. But only prudent entrepreneurs can be able to make this stage success.

Note that if the stage is done haphazardly, it implies the following stages may not materialize perfectly as your business advances.

Angel investment funding

One's startup initializes operations; there come the cravings to grow and advance to certain heights. To scale up, one might think of product development, marketing, human capital improvement, branching, and much more—all these need heavy funding. Nothing can be done in the stage without sufficient capital and hence the necessity of angel funding.

Accredited Angel investors are persons with a net worth of one million every year as per the SEC's definition. They either fund from their resources or as a group. Therefore, they part away from other investors in terms of what they expect.

Often, they need assurance of profits and not a loss. Since they invest in your business to earn a certain commission as return on capital. Usually, a good and well-researched idea will win an angel investor. On the contrary, a poorly structured idea with less to show might not get an investor.

Venture capital financing

It is often sought to increase business channels, enhance marketing, and increase customer segmentation. It is for a new wave of investment in a business. Therefore, it is funding at the stage where the business is fully established, and the only thing remaining is diversification to improve in the size of the venture.

But diversification might be more demanding in terms of brand identification, human capital improvement, and marketing. A lot is needed for the same, including expert advice and guidance. Therefore multiple funding is a necessity.

However, before getting this funding from investment companies, a lot will be demanded from you because of the Simple Agreement for Future Equity.

Mezzanine Financing & Bridge Loans

A fully established business will not just hang up on everything investment and enjoy the limited profits. No! It will seek to grow its operations further and take command of the market. In such a case, mergers, exploration of new markets, and more acquisitions must take place.

These are crucial pursuits for business and demand most financing hence the need for this funding. Usually, it is payable with profits; hence it should be perused with many keen interests. The funding from such can be obtained from huge credit offers like banks, Saccos, and other lending firms.

Initial Public Offering

When every business riches the maximum potential heights, keeping the momentum higher is the only option, hence going public. It is often in terms of public shares that help integrate creativity and talents to archive the highest level of exceptionality in operations. This funding is not that much needed, but its process is a way to increase public participation in business.